Decoding Social-Media Finance: Friend.Tech and many more

Friend.tech hit $8.1 M within days of its launch. Its overarching success invoked others to join the hype.

With the slogan of "A Marketplace for Friends", Friend.tech took over Ethereum's layer-02, Base Network within a day of its Beta Debut. The idea of buying people's online existence as shares and going as far as trading them might sound outlandish at first, but people seem to have cozied up to the idea as long as it is not stated explicitly! Aside from making a huge amount of money within a very short time, the application has taken over the Base Network through its user activities. It has managed to reach a trading volume of $8.1 Million within days of its debut.

Friend.tech's overarching popularity inevitably raises the question of the potential of social finance and what things could look like in the future. Let's delve deeper to understand the ongoing hype and if this could dictate the future of social finance!

Defining the App

The prime activity of Friend.tech is to allow its users to buy/sell their keys in form of shares. The owners of these shares/keys get access to the particular creator's private chat room access and other exclusive content that the creator chooses to provide. Yes, the idea hasn't been too foreign since Onlyfans and Patreon have been around for quite a while now. But it is still worth the hype since influencers from Twitter have gone straight in for the hype. However, things actually get interesting when the subject of trading comes in. These shares can apparently be sold as they are bought. Each time a share is sold/re-sold, the influencer i.e., the original owner of the share gets a percentage from the incentive.

Friend.tech: Is It truly friendly?

As a decentralized social media platform, there is no denying that Friend.tech has gained significant attention in the crypto community, boasting impressive numbers (approximately $8.1 million) in trading volume within its invite-only beta launch. However, it is not very uncommon in the crypto space for specific projects to experience a sudden bloom only to fail with the shifting hype. To determine whether friend.tech is merely caught up in the hype or has real potential, it is important to evaluate key aspects, including its origins, roadmap, data privacy, and overall transparency.

Friend.tech, despite its impressive metrics, faces early stumbling blocks. It gained rapid adoption, boasting 126,000 transactions and significant trading volume, even surpassing OpenSea. Yet, issues like network outages, lag complaints, and app crashes tarnished its launch. A cause for concern also lies in its origins. The app came out of a pseudonymous developer called Racer, who was once tied to the TweetDAO project. Unfortunately, the project faded into obscurity with no accountability from the creator's side. The lack of a clear history and the suspension of TweetDAO's main Twitter account raise doubts about the reliability of friend.tech's creators. Furthermore, the lack of transparency regarding friend.tech's roadmap is equally shady. Its website barely divulges information about its founders, a whitepaper, or long-term goals, which reputable projects typically provide. The absence of a privacy policy also leaves users in the dark about their data's fate. Adding on, Friend.tech's pricing model, though straightforward, carries a hint of speculation, governed by a quadratic formula based on supply and demand. This could potentially inflate share values.

The platform's promise of monetizing social networks and offering lucrative returns sounds enticing but, it is yet too far from being a trustworthy one.

Just Another Hype?

Like every other crypto innovation, friend.tech has received a lot of criticism for the issues mentioned earlier. A lot of those criticisms have been indicative of the whole thing being a Ponzi scheme. Although there has been no clear direction of how this certain phrase is being allocated to the case, the sustainability question still stands valid; i.e., whether the app is here for the long-term or not.

The answer to this is simple: given the conditions and application's functionalities, there is a thin chance of this specific application staying for a prolonged period of time. Aside from the creator of the app being previously involved in financial experiments and leaving them to fail, the valuation system of the whole platform is not enough to convince users to stay. There have also been ethical questions raised on the subject of selling and buying a "person's" share as this materializes human existence to an extreme level. But that is the least of the concerns. The real challenge lies after the Airdrop. Although people have already made tons by trading shares of influencers and X's content creators have significantly levitated their revenue, it is highly unlikely to stay the same simply because there are better options and subscription-based platforms where creators can simply earn more. This has been explicitly stated by one of the content creators who left the platform for the amount it made them was trivial compared to other platforms. In terms of user numbers, may of them are driven by the onging hype. Eventually, the user numbers are likely to drop after the Airdrop.

Post.Tech on Arbitrum

Following the successful debut of friend.Tech, Post.Tech emerges as an intriguing player. Post.Tech positions itself on the Arbitrum network, known for its efficiency and cost-effectiveness, offering users an interface reminiscent of the familiar Twitter platform. This user-friendly design aims to engage social media enthusiasts, potentially widening its user base.

While Friend.Tech primarily focuses on private messaging, Post.Tech brings an innovative twist by allowing users to turn their profiles and posts into tradable tokens, effectively adding a financial layer to social interactions. This feature introduces an enticing incentive for users to engage more actively on the platform, with the promise of cash rewards distributed proportionally based on their activity. Last week the platform experienced a notable upswing in trading volume, with more than $1.8 million recorded in a 24-hour period, and daily transactions soaring from 2,000 to 87,000, showcasing its rapid growth.

Although Friend.Tech has accumulated substantial protocol fees, which surpass the $14 million mark, Post.Tech's recent surge in activity highlights its potential to compete effectively in the SocialFi landscape. Moreover, the straightforward and transparent rewards model of Post.Tech, distributing cash sums based on activity, may be more appealing to users seeking clarity and immediate benefits.

While Friend.Tech benefits from a head start, Post.Tech's swift rise suggests that its user-friendly design and transparent rewards system resonate with a growing audience. Nonetheless, both platforms face the critical challenge of sustaining user engagement beyond the initial allure of rewards, especially given the high fees associated with their operations. The future of SocialFi may well depend on their ability to adapt, retain users, and evolve in a landscape that is still taking shape.

Alpha in Bitcoin

Alpha, a novel social token network, has recently emerged as a competitor to the Friend.tech platform. Built on the Bitcoin blockchain, it creates a unique ecosystem for community-based social tokens.

Alpha shares similarities with Friend.tech by enabling users to monetize their online presence and content through social tokens. However, the true difference lies in its architecture. Alpha's finality is rooted in the Bitcoin blockchain, with the Polygon blockchain used for data storage, and its own scaling network, Trustless Computer, serving Bitcoin.

Punk3700, one of Alpha's co-founders, describes Alpha's architecture as "a rollup that rolls up to another rollup that rolls up to Bitcoin." In his words, this layered approach aims to enhance security and efficiency for deploying decentralized applications. The hybrid design leverages Bitcoin for data validity and Polygon for data storage, ultimately settling on Bitcoin to mitigate the high transaction fees associated with Bitcoin.

The design is user-centric, with a strong community-driven development approach. The platform has rapidly amassed users since its launch, with almost similar functionalities as Friend.tech (i.e., allowing users to purchase tokens tied to content creators, granting access to exclusive content.)

In essence, Alpha's emergence on the Bitcoin blockchain presents a competitive alternative to Friend.tech. Alpha's user-centric approach, layered architecture, and lower transaction fees have allowed it to occupy a fair share of attention as an attractive option for both content creators and users.

Conclusion

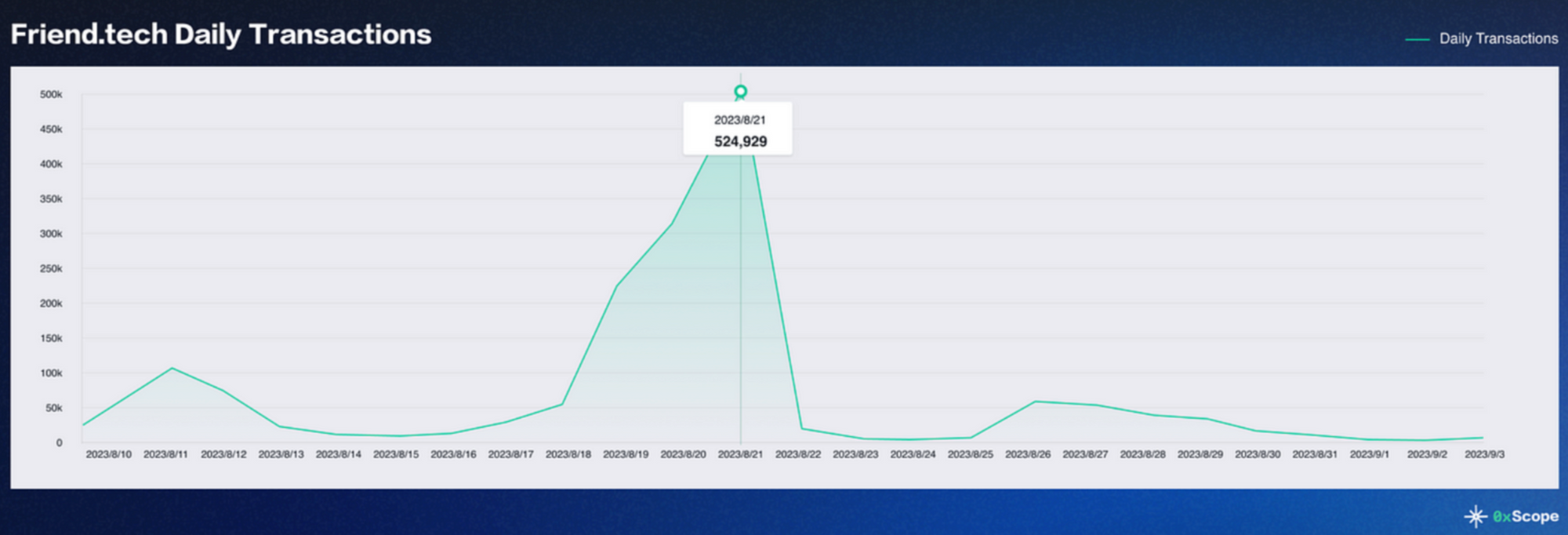

Following last week's occurances, Friend.tech has come to an unfavourable position which includes a decline in key metrics like user activity, inflows, and volume. It also grappled with rumors of a data leak, although these were refuted by the platform. Friend.tech recently opted to penalize users who migrate to copycat versions of its platform, a move aimed at rewarding loyal users during its beta phase. It is evident that the bubble has already burst and the platform is struggling to keep up.

Despite the fragility of Friend.tech's regulatory mechanism, the idea behind it was able to bring forth a multitude of platforms– each of them varying in their own ways and yet bearing the core idea of Social Finance. Their efforts mostly related to monetizing content and creators through Blockchain technology. Since social media is such an undeniable part of our lives, making a financial structure out of it, where people can actively participate and monetary rules aren't decided by some centralized authority.

In conclusion, whether Friend.tech becomes a success or not, the emergence of several similar platforms building on the idea is indicative of the fact that the core idea of Friend.tech has the potential to drive a new wave of collaboration between web3 and social media.